Some encumbrances involving securities affect the marketability of those securities. For example, if an investor uses the securities in a brokerage account as collateral for a loan from the brokerage, they may not be able to sell them. Or, if the investor can sell them, the brokerage would be entitled to enough of the proceeds to repay the loan. An encumbrance is a claim against a property made by a party who is not the property owner. If management approves, the IT department writes the purchase order, which creates the encumbrance. Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

Pre-Encumbrance

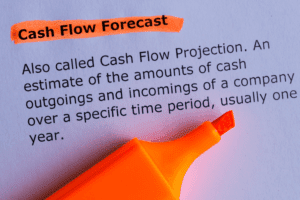

By using encumbrance accounting, companies can gain better visibility and control over their expenditures, as well as prevent fraud. Additionally, encumbrance accounting allows for more accurate predictions of cash outflow. By monitoring encumbrances and analyzing their balances and activity, companies can gain insights into upcoming expenses and better manage their cash flow. By tracking encumbrances, companies can more accurately allocate funds, ensuring that budgets are adhered to and that resources are used efficiently. This helps prevent budget overruns and provides greater transparency in financial planning.

Accurate expenditure control

- AI is going to fundamentally reshape the accounting landscape by automating routine tasks and commoditizing traditional deliverables.

- It also enables better decision-making by providing a comprehensive view of future payment commitments and available budget.

- With encumbrance accounting, future payment obligations are recorded in financial documents as projected expenses.

- These systems enable organizations to automate encumbrance tracking, generate accurate reports, and facilitate data reconciliation.

- Verify purchase order transactions so you can see what encumbrances materialized into actual paid expenses.

- There are different encumbrance types, ranging from reserves for payroll to money set aside by budgetary control groups for things like contingency expenses.

Be sure to allocate the encumbrance to the appropriate account and ensure accurate tracking. While encumbrance accounting provides significant benefits, certain challenges and considerations must be carefully navigated, particularly in the government, public sector, and non-profit realm. These sectors have unique characteristics that can impact the implementation and effectiveness of encumbrance accounting systems.

Recording Encumbrances

When the encumbrance amount gets added to the general ledger, you can remove the payment from the pre-encumbrance amount. Once the vendor approves the transaction, the commitment converts into a legal obligation. While appropriations are money set aside for budgetary line items, encumbrances are reserves for a specific item. An Encumbrance is a type of transaction created on the General Ledger when a Purchase Order (PO), Travel Authorization (TA), or Pre-Encumbrance (PE) document is finalized. On this website, you will find information about Mitch Hoffman CPA, P.C., including our list of services.

Future Trends in Encumbrance Accounting

The software also generates detailed reports that aid in monitoring encumbrance balances and analyzing expenditure patterns. By carefully and accurately tracking your encumbrance amounts, you also increase spending visibility. It reduces unnecessary spending when tracked this way and can help catch any fraudulent purchases more quickly. Overall, it can assist in making purchasing information more transparent and easily accessible when needed to enable tracking and overspending prevention.

Hotplate efficiently manages their AP volume with Routable

Implementing encumbrance accounting requires careful planning and execution to accurately calculate and track encumbered amounts for future payment commitments. It is essential for organizations looking to enhance their financial management and budget control. A structured approach is necessary to ensure the successful implementation of encumbrance accounting systems. Encumbrance accounting is a crucial financial tool that allows companies to track future payments and expenses, providing a detailed view of cash flow. It is a method that helps businesses reserve funds for future liabilities, ensuring accurate financial reporting, budgeting, and analysis.

What If I Buy Real Estate With an Encumbrance?

- In conclusion, monitoring and analyzing encumbrances provide organizations with valuable insights into budgetary control and financial planning.

- Encumbrances are accounted for in the balance sheet as reserved fund balances and can be adjusted or carried forward at the end of a financial year.

- Or, if the investor can sell them, the brokerage would be entitled to enough of the proceeds to repay the loan.

- The other is to identify potential over-expenditures before they occur by verifying whether the budget has sufficient funds to cover the actual and hidden costs.

- ClearTech also gives you complete visibility into your finances in the form of interactive dashboards and lets you gain control over your budgets.

- But, if the encumbrance amount has to be altered for any reason, that will either increase or decrease the appropriations account.

For example, Jennifer owns an easement, that she negotiated with her neighbor, that gives her the right to use her neighbor’s well. Browse hundreds of articles, containing an amazing number of useful tools, techniques, and best practices. Many readers tell us they would have paid consultants for the advice in these articles.

By combining our expertise, experience and the team mentality of our staff, we assure that every client receives the close analysis and attention they deserve. Our dedication to high standards, hiring of seasoned tax professionals, and work ethic is the reason our client base returns year after year. If anything, the smaller firms are going to actually gain the advantage in this new era, https://www.bookstime.com/ as they are less encumbered by the serious overhead that drags down profit margins. AI will enable much of the work of entry-level and early-career accountants to be replaced by AI-powered tools already available to firms of all sizes. Experts and observers are wringing their hands over AI’s threat of taking jobs away from humans and certainly in accounting that will be the case.

- These advancements will streamline the encumbrance accounting process, allowing for more efficient tracking of future payments and expenses.

- It’s then automatically sent to the department head and anyone else who must approve the purchase based on the approval workflow rules and thresholds that have been set up in the Planergy system.

- Whether you are an individual or business in or around Flint, Mitch Hoffman CPA, P.C.

- Non-profit organizations also encounter challenges when implementing encumbrance accounting.

- This can include purchase orders, contracts, or any other obligations that have not yet been fulfilled.

- Each type of encumbrance is meant to protect parties and specify exactly what each claim entails.

Leave A Comment