The software organizes financial information efficiently, but mastering full utilization of its reporting features can take time. It allows three users for its Essentials plan ($55 per month) and 25 users for its top plan, the Advanced ($200 per month). This can be helpful if your company is growing fast, or you simply want the reassurance that there’s no limit to how many people can be part of the team.

- Xero is accounting software for small business owners who need an affordable, easy-to-use online accounting solution that includes invoicing, data capture and storage, and bill payment.

- You can choose how often customers receive reminders, and turn off reminders for specific customers or invoices.

- If you use the Established plan, you can track billable time to add to projects.

- It may take a day or two to get a response to your email, but there are plenty of other forms of support available.

- Xero Expenses feature allows businesses to track and claim their expenses.

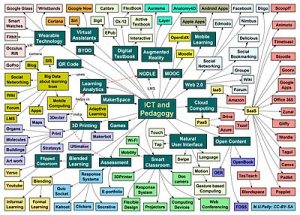

Does Xero integrate with third-party applications?

We researched and analyzed dozens of the best accounting and invoicing software solutions to help small businesses choose the right accounting software for their needs. Our information sources included the company’s website and software demos. Additionally, we studied user reviews for independent opinions on the software’s pros and cons. When looking for the best accounting software for growing businesses specifically, shockwave aesthetics we focused on pricing tiers, the number of integrations, and the breadth of features and tools. Xero is robust, cloud-based software with strong accounting, ample integrations, and some great features.

Summarizing this review, Xero emerges as a potent accounting solution, particularly for small to medium-sized businesses. Its strengths lie in its user-friendly interface, comprehensive feature set, and flexibility offered through various integrations. While it might fall short for larger enterprises with complex, specific needs, it remains a formidable option for its target market. Navigating Xero is relatively straightforward once you get accustomed to the interface, which is designed with clarity and simplicity in mind. However, the initial learning curve can be steep, especially for those new to digital accounting solutions. The onboarding process is comprehensive, offering setup assistance and a step-by-step guide, yet some users might find the abundance of features overwhelming at first.

Xero Feature

You can also scroll through Xero’s default chart of accounts and customize it as needed, or import an already existing chart of accounts. If you have a list of customers and suppliers, you can import that, too. Yes, you can use Xero for free using its 30-day free trial to test its functionality. Its ability to give a clear, comprehensive financial snapshot stands out, especially valuable for decision-makers needing clarity without sifting through complex data. In essence, Xero harnesses technology to offer efficiency, a clear overview, and above all, business financial transparency.

Inventory Management

FreshBooks has a deal running where you can save 50% for the next six months. Xero users benefit from streamlined invoicing and payment processing, which makes managing their payments easy. They can create and send invoices and track payment status from the same platform. Thus, the scope for manual data the difference between a trial balance and balance sheet entry is reduced, and cash flow accelerates. Xero also offers flexibility and convenience to all businesses by integrating various payment gateways. Xero is a New Zealand-based public technology company that specializes in cloud-based accounting software for small and medium-sized businesses.

Can I pay for Xero annually?

Xero Expenses feature allows businesses to track and claim their expenses. It supports paperless expense tracking by scanning receipts and auto-filling claims from the scanned copy. With Xero, admins can review and approve expense claims submitted by employees. Besides an overview of unpaid bills, expenses, and purchase orders, Xero displays bills in different categories, such as draft, waiting for approval, or ready to be paid.

Xero includes extensive features that make it suitable to handle complex accounting processes for small- and medium-sized businesses as well as larger ones. The software makes it easy to pay bills, claim expenses, accept payments, track projects, manage contracts, store files and more. Growing businesses need accounts payable vs accounts receivable data presented in an easily digestible manner so business owners can act on the insights. During our software demo, we found that Xero’s reporting features can help you make sense of the data analytics at your disposal. Xero’s reporting tool distills your accounting data into easily digestible bar charts, pie charts and other graphs.

However, the average time is likely closer to 3-4 weeks as users become more familiar with the software through consistent use. To its credit Xero does have quite a lot of help and support options at your disposal. There are handy built-in options that can get you around any minor issues you might encounter during setup. This is most notably handy thanks to the question mark up in the right-hand corner of the interface, which delivers and express-lane dialog box for solving many common queries.

Xero uses double-entry accounting, but it’s mostly done behind the scenes. Users can access connected apps or add new ones by clicking on the app launcher icon. You can turn the sample dashboard on to get an idea of how your dashboard could look once it’s populated with your business’s data. As with any software solution, I recommend you weigh Xero’s pros and cons carefully against your business’s unique needs. If you have any personal insights or experiences with Xero, feel free to share your thoughts in the comments below. Your input could be invaluable for others trying to make this important decision.

Leave A Comment